The Future of Compliance: Emerging RegTech Trends for 2024 - Proxymity

As we approach the end of 2024, Regulatory Technology, or RegTech, has solidified its crucial position in the financial services industry. In an era of constant regulatory change, heightened scrutiny, and the digital transformation of financial institutions,

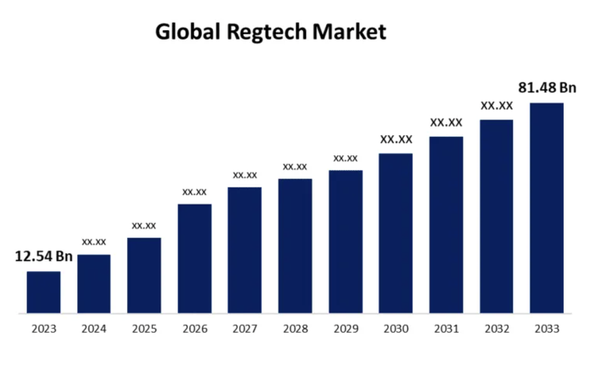

RegTech solutions have become indispensable tools. The market is constantly growing, with the global sales of RegTech estimated to have hit a market value of nearly $13 billion in 2023 and anticipated to reach a value of almost $82 billio...